A Division of The Office of Budget and Finance

The Payment Clearinghouse (PCH) is a repository for authorized users to record information regarding expected electronic payments (ACH, Wire, and EFT) and to search and record payments that have been misdirected to an area other than that which was intended. Individuals interested in participating are required to read this document to gain knowledge about PCH's functionality prior to using it.

The three major functions of the Payment Clearinghouse are as follows:

Participating users will receive automatic email notifications of newly found payment postings.

NOTE: This procedure does NOT cover credit card payments. For credit card payment processing, refer to Policy FN07 Electronic Payments-Credit Cards and the PSU Merchant Management website.The Payment Clearinghouse is located online at https://app.fis.psu.edu/pch.

The following documents the process by which unidentified payments and expected electronic payments are to be handled via the Payment Clearinghouse system.

PROCEDURE:

DEPOSITING MISDIRECTED PAYMENTS:

When a department has erroneously received a payment, all efforts should be made to locate the correct recipient. If these attempts are unsuccessful, the individual receiving the payment will deposit the check or record the wire transfer (as applicable) by preparing a Cash Deposit Journal Entry in SIMBA, debiting the appropriate bank clearing account and crediting General Ledger Account 22020050 Surplus Deficiency. In accordance with Policy FN01 Cash Revenues, all monies received by any department or area of the University must be deposited as quickly as possible and reported in a timely manner.

Because of separation of responsibilities concerns, if the payment was posted by individuals within the Financial Reporting department, Accounting Operations will process the Cash Deposit Journal Entry on their behalf.

REQUESTING ACCESS TO THE PAYMENT CLEARINGHOUSE:

The recommended users of the Payment Clearinghouse are those individuals who are responsible for maintaining accounts receivable systems and those individuals and areas that routinely receive electronic payments. Access to the Payment Clearinghouse is coordinated through a Business Area's Financial Officer or designee. The Financial Officer or designee must contact the PCH Administrator to add the authorized user.

ACCESSING PAYMENT CLEARINGHOUSE:

In order to access the Payment Clearinghouse application, the user must first log into their "Web Access" account with valid credentials. Upon successful web access authentication, users will be directed to the home page of the Payment Clearinghouse application.

REPORTING AND CLAIMING MISDIRECTED PAYMENTS:

To Post a Payment That Does Not Belong to You:

Deposit the misdirected payment and prepare a Cash Deposit Journal Entry to record the payment in accordance with the instructions in Depositing Misdirected Payments.

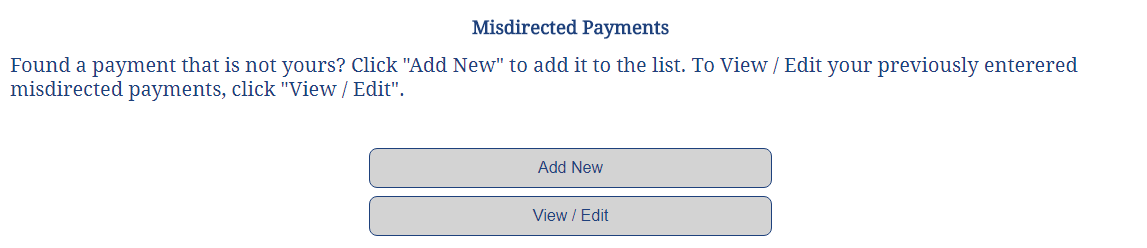

From the Payment Clearinghouse main page, select the Misdirected Payments function and choose "Add New".

A form will appear that will allow the user to post the appropriate information regarding the payment. Fill out the required form fields (indicated with a red asterisk) OR click "reset" to clear all form fields.

Once submitted (by clicking the "Add" button), the payment will be added to the list of unidentified payments appearing under the View/Edit function. If the record has been added successfully, a message will be displayed notifying the user. The system will also automatically generate email messages to alert each Payment Clearinghouse subscriber of the posting.

To View Misdirected Payments:

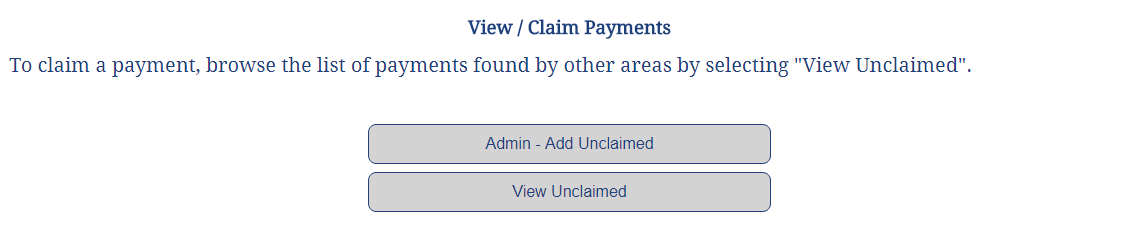

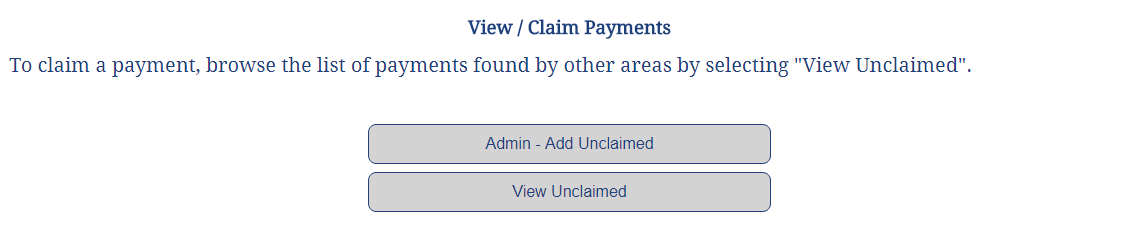

If you wish to view the list of current misdirected payments, select the "View Unclaimed" option from the "View/Claim Payments" section.

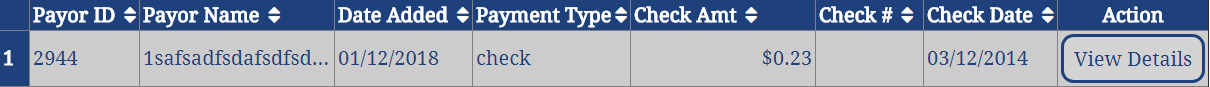

A list of all current misdirected payments within the PCH database will be displayed on the screen.

To Edit Previously Entered Misdirected Payments:

If you wish to edit a misdirected payment that you previously entered, select the "view/edit" option. Your list of previously entered payments will then be displayed on the screen.

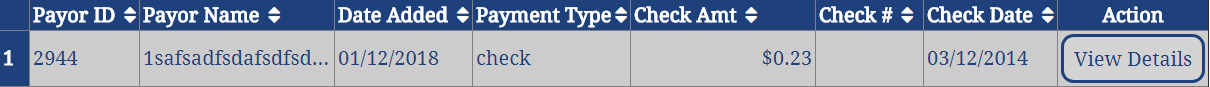

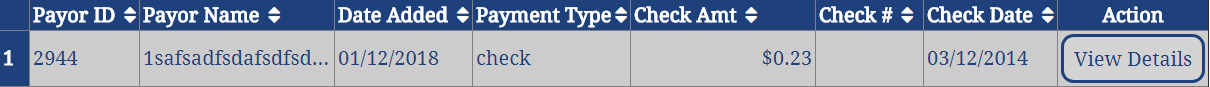

Click the "View Details" button on the desired record row and all information pertaining to this record will display.

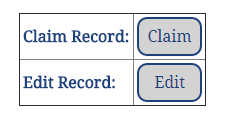

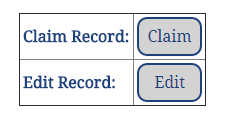

Scroll to the bottom of the page and select "Edit."

Update the desired form fields and the "Edit Unclaimed Payment" form and click "Update." The database will now reflect the changes.

To Browse Misdirected Payments List and/or Claim a Payment:

Users can view the list of unidentified payments that have been posted by others by selecting the "View/Claim Payments" function on the Payment Clearinghouse main page and selecting "View Unclaimed."

A list of all current misdirected payments within the PCH database will be displayed on the screen. Select "View Details" on the desired record row and all information pertaining to this record will display.

Scroll down towards the bottom of the page and select "Claim."

The claim form will automatically pre-populate with YOUR user information. If you are claiming this payment on behalf of someone else, update the form fields to reflect their information. Supply a value for the "SIMBA" form number and click "claim." The record will now be archived within the database.

- If the entry has the status of "Unclaimed" this item has not been posted to any account. You must prepare a Cash Deposit Journal Entry for cash or checks or a Journal Entry for EFT (Wire or ACH) transactions, debiting the appropriate bank clearing account and crediting the appropriate cost center or internal order.

- If the entry has the notation "Posted 22020050" this item has been posted to the GL22020050 Surplus Deficiency and you must prepare a Journal Entry, debiting GL 22020050, Surplus Deficiency (your Business Area, Fund 1100000001 and Grant NOTRELEVANT), and crediting the your department Cost Center or Internal Order.

To Correct Erroneous Claims:

Accounting Operations has the means to "unclaim" a payment which was erroneously claimed via "administrative" access to the system. To correct such an error, contact Accounting Operations.

POSTING AND EDITING EXPECTED ELECTRONIC PAYMENTS:

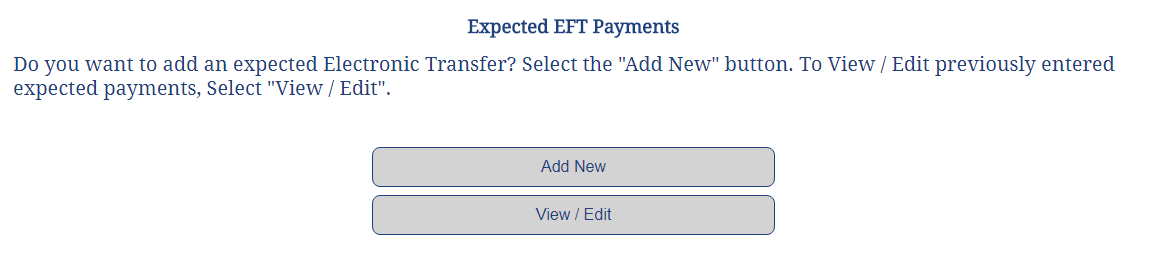

The Payment Clearinghouse also allows an area to post information regarding an electronic payment they are expecting to receive. This will be monitored by Financial Reporting.

Adding an Expected EFT Payment:

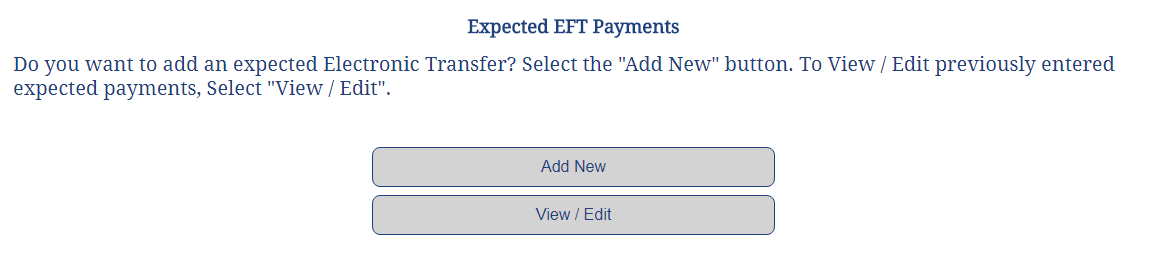

From the Payment Clearinghouse main page, use the "Add New" function within the Expected EFT Payments section. Expected payments must be added prior to the funds being sent.

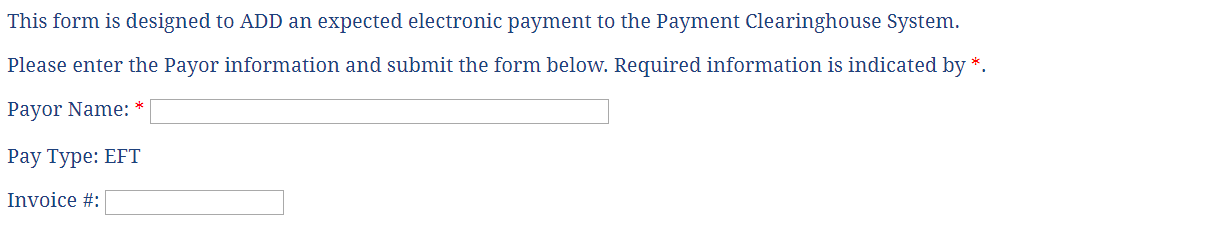

A form will appear that will allow the user to post the appropriate information regarding the expected transfer.

When the form is completed, the user will click the "Add" button to record the expected payment. If the record has been added successfully, a message will be displayed notifying the user.

To View and Edit Expecting EFT Payments:

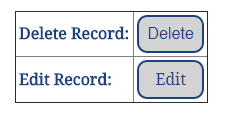

Choose the "View/Edit" function if changes need to be made after their initial posting. To delete the item, select the "Delete" button. Select the "Edit" button to make changes. The previously-entered information will be displayed and can be changed as desired. (Note: Only the User who created the record will be able to edit the entry). Once revised, select the "Update" button to record the edits made.

Financial Reporting has, via "administrative" access to the system, the means to edit an entry if the User who created the form isn't available. Contact Financial Reporting if this situation occurs.

Any electronic payment with an expected date beyond one year will be removed from the system automatically.

Delete an Expecting EFT (General User Access):

If your user role is defined as "General" you have the ability to delete records that YOU previously entered. Select the "View/Edit" option.

Your list of previously entered payments will then be displayed on the screen. Click "View Details" on the desired record row.

All information pertaining to this record will now be displayed. Scroll towards the bottom of the page and select "Delete"

Confirm deletion by selecting "OK" from the pop-up dialog box. The record is now removed from your list. This record can now only be referenced by an administrator.

USER ACCOUNT INFORMATION:

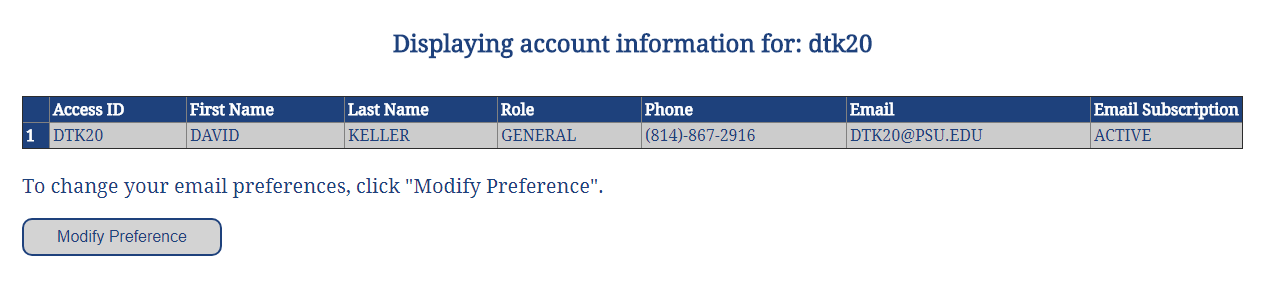

To View User Information:

To view "your" user information, select the "User Info" navigation button located at the top of the Payment Clearinghouse home page.

Your user account information will be displayed on the screen.

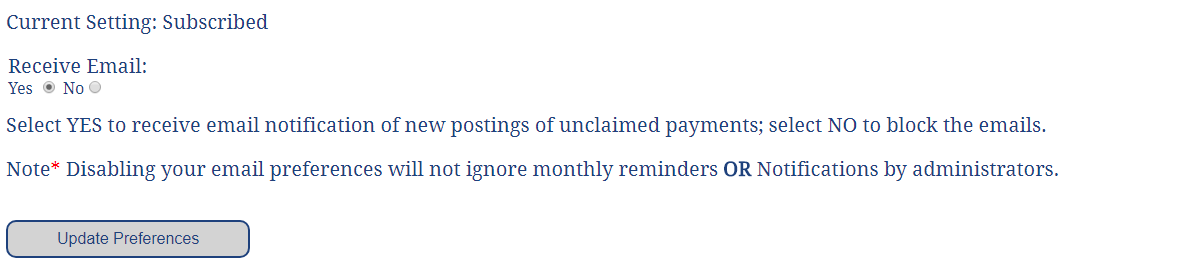

Update Email Preferences:

To subscribe or unsubscribe from PCH email notifications, select the "Modify Preference" option.

Select the desired preference on the form as picture below:

Click "Update Preferences" to save your preferences and the system will update your status.

Send PCH Support Email:

If you wish to send a support email to PCH administration, click the "Contact" tab on the navigation pane.

Provide a subject description, enter a message within the provided text area, and click "submit."

VIOLATIONS:

Violation of a financial policy and/or procedure should be reported to your supervisor, unit manager, Human Resources representative, and/or office responsible for the policy and/or procedure. Where those resources are inadequate, you may choose to make an anonymous report through the Penn State University hotline by calling 1-800-560-1637.

AUDIT COORDINATION - FINANCIAL AND PROCEDURAL

The Financial Officer is responsible for ensuring that procedures pertaining to the accountability and safeguarding of all cash receipts, cash funds, and other assets are established and followed in accordance with approved University policies and procedures. Regular audits relating to advances, cash, travel, equipment accountability, and other expenditures provide a means to protect University assets. The Financial Officer is responsible for working with Internal Audit when audits are being performed in the administrative area. Audits relating to sponsored activities or other audits performed by external auditors may also be performed. The Financial Officer would also be responsible for working with the external auditor and/or a central university office related to these procedures.

UNIVERSITY RECORDS RETENTION AND DISPOSITION:

In accordance with Policy AD35 University Archives and Records Management, claimed payments will be retained in the Payment Clearinghouse database from the end of the fiscal year in which it was claimed plus 3 years. This retention coincides with the retention requirements for bank statements.

University Records must be retained and managed in accordance with Policy AD35 University Archives and Records Management and the University's Records Retention Schedules that have been approved by the Records Management Advisory Committee (RMAC), the Office of General Counsel, and Senior Vice President and Chief of Staff. These Records Retention Schedules are derived from - or based upon - federal, state, and local statutes or regulations (i.e.; Federal Acquisition Regulations, the OMB Uniform Guidance, Internal Revenue Service, and other regulations governing the auditability and retention of financial records), University Policy, industry standards, and business needs. All University Records must be maintained in such a manner to provide ease of access, establish a suitable audit trail for all transactions, and to be reviewed prior to disposition.

Upon completion of the retention period, University Records must be disposed of via secure destruction or transfer to University Archives, unless an exception to the disposition process set forth below applies. In many cases, retention periods and disposition methods may be generally determined by comparing the type of record (i.e., reports, correspondence, etc.) to similar records series with known retention periods listed on the Records Retention Schedule. If the disposition method for University Records states "Review by Archives" on the Records Retention Schedule, the Unit responsible for those records should consult the University Archivist for a final determination of disposition. For University Records that must be securely destroyed, units may arrange for shredding services by either contacting the Blue/White Shredding Program or the Inactive Records Center (IRC).

Exceptions to the disposition process are as follows:

- University Records subject to a Legal Hold (see Policy AD35, Legal Hold). A legal hold will remain in effect until it is released in writing by the Office of General Counsel.

- University Records under audit or review, either internally or externally. An audit hold will remain in effect until the hold is released by the Office of Budget and Finance. The Financial Officer will be notified regarding any cost objects that are under audit hold; the Financial Officer will be responsible for contacting the Unit associated with the cost objects.

To safeguard the privacy of individuals, records that contain Personally Identifiable Information (PII), as defined in University Policy AD53 Privacy Policy, or student records, as defined in University Policy AD11 Confidentiality of Student Records, must be securely destroyed beyond recovery. For additional information regarding privacy and the protection of an individual's personal information, see Policy AD53 Privacy Policy.

Additional questions may be directed to the Records Management Program.

EXHIBITS:

No associated exhibits

CROSS REFERENCES:

- Policy AD11 Confidentiality of Student Records

- Policy AD35 University Archives and Records Management

- Policy AD53 Privacy Policy

- Blue/White Shredding Program

PROCEDURE STATUS:

Date Approved:

July 13, 2022

Most recent changes:

- June 1, 2023 - Editorial changes: In the “To Browse Misdirected Payments List and/or Claim a Payment” section, Business Area 5210 was replaced with "your Business Area" per the request of Financial Reporting. This change is to have the Journal Entry approved within the Business Area, not in Central Finance.

Revision History (and effective dates:)

- February 1, 2023 - Editorial changes: Changed all references to the Associate Vice President for Finance to the Associate Vice President for Budget and Finance, per the directive of the Senior Vice President for Finance and Business.

- January 20, 2023 - Editorial changes per the directive of the Associate Vice President for Finance:

- Changed all references to the Office of the Corporate Controller to the Office of Budget and Finance

- Changed all references to the Corporate Controller to the Associate Vice President for Finance

- Changed all references to the Vice President for Administration to the Senior Vice President and Chief of Staff

- Revision 3. - dated 7/13/2022 - Major changes to procedure due to the implementation of a SIMBA financial system

- Revision 2. - dated 1/12/18 - Major changes to procedure due to the implementation of a new Payment Clearinghouse software system

- Revision 1 - dated 10/07/11 - Major changes to both procedure and the Payment Clearinghouse system itself, in response to internal audit of the treasury function.

- Revision 0a - dated 03/20/00 - Editorial change; Pat Auker replaced Gerry Webster

- Original - dated 08/20/98